Today, despite the expansion of e-commerce, the progression of internet purchases remains relatively slow : a 2% increase between 2013 and 2018. According to the "Fédération du commerce et de la distribution", in France, 91% of purchases in 2018 were still made in a physical outlet, and the role of the store in the purchasing process remains considerable today.

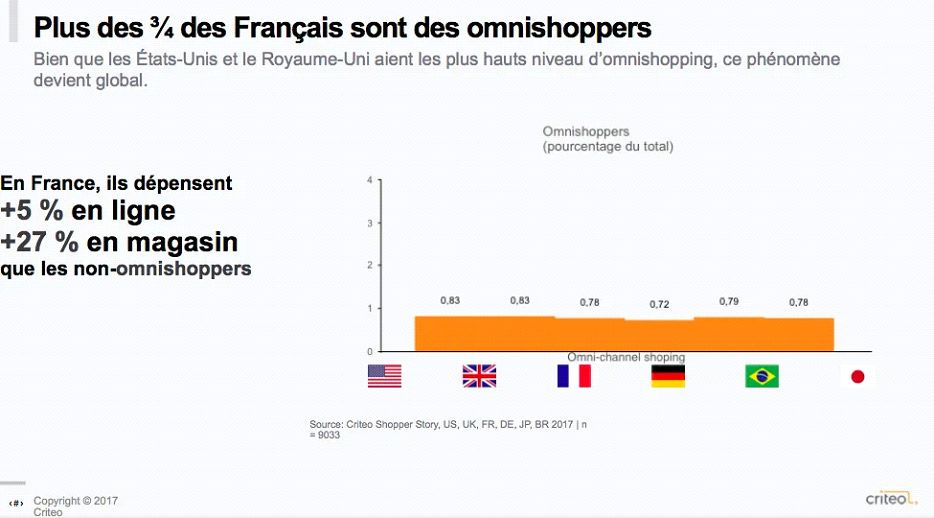

According to the "Shopper Story" study published in 2017 by Criteo, (Criteo, 2017) analyzing consumer behavior in six countries, three-quarters of the French are "omnishoppers", i.e. consumers who use several distribution channels to obtain information and make purchases.

The French and omnichannel

According to a study by (Fleishman-Hillar, 2010), the Internet saves consumers a considerable amount of time and facilitates their decision-making. Indeed, rapid access to a wealth of information (product/service description, Internet user reviews, ratings, etc.), as well as the ease of movement and purchasing on the Internet, make consumers more demanding when it comes to their experience in a physical outlet. Today's challenge for the physical store is to offer a seamless, fluid customer experience between the point of contact on the Internet and the point-of-sale experience, with the aim of simplifying the purchasing process, guaranteeing brand loyalty and ensuring customer satisfaction.

A company's competitive advantage is the set of offerings that differentiates it from its competitors and gives it an edge over them.

Since Wided Batat first evoked this concept in 2017 (Batat, 2018), 3 major values have been identified: functional value, relational value and emotional value.

The emotional benefit is the most complicated to achieve during an act of purchase.

Once achieved, it enables the customer to make an impact, implanting itself in their memories, stimulating their acts of purchase, increasing their attachment to the brand and notably enabling the creation of a lasting relationship. However, it is difficult to achieve, as it involves creating an emotion between a consumer and the target product. Today's retail players are revisiting and improving the customer experience to trigger emotions and guarantee brand loyalty. Dairy industry players, for example, use the family image in their promotions, conveying kinship links and emotions of joy and nostalgia through their communications.

The evolution of the retail sector is underway, taking advantage of the best digital tools and connecting online and offline; retailers are developing the principle of omnichannelity. This principle makes it possible to multiply points of contact and guarantee the user experience between online and offline. We observe that web players such as Alibaba and Amazon have already invested in physical points of sale with the aim of combining the "on" and "off" and offering a cross-channel experience . Since 2014, Alibaba has invested over 12 billion including 635 million dollars in Chinese Ikea Red Star Macalline as well as supermarket chain Hema Fresh . In parallel, Amazon has invested $15 billion in 2019 alone. In particular, the American company has launched Amazon Go cashless stores, acquired Whole Food Market and opened numerous physical outlets. These events are disrupting the traditional store model and prompting traditional businesses to renew the way they operate.

Today's major challenges are to combine the online & offline experience in order to meet the challenges of information, simplification & personalization of customer journeys. For brands, the challenge is to offer an experience in which the consumer feels considered by the brand, so as to develop a bond of attachment.

In light of all these findings, what levers can brands pull to adapt to customers and offer the best experience?

Current solutions

The main axis of diversification in the retail sector is the digitalization of points of sale. The sector's digital transformation is having an impact on a wide range of stakeholders, including retailers, consumers, suppliers and service providers. In particular, the digitalization of the sector involves :

Marketing & Sales department:

- These tools enable us to collect information on consumers' purchasing behavior anonymously. In the same way as e-commerce players, retailers are looking at consumer types, purchasing behavior, engagement rates, conversion rates, etc. Brands, for example, are developing product displays or corners equipped with all kinds of sensors to analyze consumer behavior (distance travelled, time spent in front of the display, stopping place, etc.). This data provides KPIs that can then be translated to adjust systems, analyze the rate of engagement and determine return on investment.

- Data management enriches customer knowledge. It enables us to address them in a more relevant way, and to be more responsive to the actions we propose.

- Data analysis can be used to measure the return on investment of tools and furniture (sensors and other measurement systems for POS, displays and corners).

- Consumer insight significantly reduces the cost of mass marketing campaigns, in favor of more targeted, personalized campaigns.

- The increase in in-store traffic has a considerable impact on the transformation rate. In fact, according to Virginie Carteron's article "Expérience client et distribution omnicanale", the conversion rate is higher in-store than online (30% in-store vs. 2% online).

- What's more, digital tools are becoming increasingly accessible and democratized. There are tools for connecting the store through various IoT, CRM systems, ERP, monitoring platforms, business intelligence tools and more... This opens up a notable path for hybrid store models.

In-store sales force:

Digital tools optimize the work of operational staff, providing them with easier access to information (concerning products, provenance, stocks, etc.). Digital tools also enable :

- provide personalized advice and product expertise. In this way, supermarket employees can concentrate on higher value-added tasks, providing the advice consumers expect when they visit physical outlets in search of answers to their questions.

- implement a digital transformation as a real support to reduce so-called "low value-added" tasks (such as inventories, stock queries or product information consultations, etc.).

At the consumer level:

- The digitalization of points of sale, through in-store digital experiences, makes it possible to further entertain the consumer.

- For example, several players are introducing interactive kiosks (Undiz Machine or KingJouet). These interfaces present the in-store offer through a playful experience. Others, such as Nike and Samsung, offer immersive journeys to immerse consumers in the brand's universe before moving on to the transaction, providing a unique experience for their customers.

- Access to more productinformation through interfaces is also an interesting way of inviting customers to discover the entire catalog.

- Get them to interact & share their experience on social networks

- Digital tools make it possible to preserve the essence of the store (product presentation, original experiences) while offering advice thanks to the sales staff at the point of sale. The latter can then focus on advice and expertise, becoming ambassadors, true representatives of brands or products. This is the case, for example, at Decathlon, where all products have been fitted with RFID chips, enabling inventories and express checkouts.

The objective for retail players is twofold:

- Multiply the points of contact with consumers to get to know them better

- Offer consumers continuity between their online and in-store experiences, notably by offering the same type of information, simplified practices/usages and a personalized shopping experience.

These objectives encourage brand attachment & consumption.

How can these new resources be integrated points of sale?

The multitude of points of contact with the consumer makes it possible to capture vast amounts of data (bigdata), becoming the sinews of war in distribution today. It's a tool for improving and transforming existing models, and a source of competitive advantage. The adoption of a "data-driven" policy provides a global view of online and offline customer behavior, making them interconnected.

According to Xerfi's study "Les Stratégies cross et omnicanal dans la distribution" (2015), the advantages of using bigdata are multiple:

- Value chain improvements from logistics to after-sales service;

- Use customer data to create value and new products and services;

- Enhancing the existing experience;

- Logistics automation to anticipate risks, improve productivity and traceability of flows & products;

- Value chain management based on real consumer needs.

Phygital convergence will be one of the dominant models, based on omnichannel.

However, in order to integrate these new tools as effectively as possible, we also need to take into account consumers' / contacts' resistance to the implementation of such a digital project.

Indeed, despite the constant evolution of tools, their industrialization and large-scale use remain problematic (due to today's technical and economic challenges), as the ROI can prove disappointing.

The automation of logistics or even the implementation of new customer paths are stuck at the experimental stage for various reasons:

- Organizational difficulties ;

- Psychological barriers ;

- Resistance to change.

Call to action

The digital transformation of retail is in full swing. It requires adaptation of information systems, the supply chain and the customer experience. The integration of these new tools is having repercussions on companies, changing their intrinsic culture, processes and working methods, while practices such as agility, XP, Lean, etc. have already proved their worth in various sectors.

These actions also requireappropriate skills. To support you ,5 DEGRÉS offers theservices of its team of experts specialized in customer experience andsupply chain automation.

Co-written by Margarita Pinchuk, Product Owner and retail expert, Charlène Bourse & Tatiana Bonnet

Bibliography

Batat, W. (2018). Designing and improving the digital customer experience.

Carteron, V. (2013). "Customer experience and "omnichannel" distribution . xpansion Management Review, p. N149.

Criteo. (2017). Shopper Story. Retrieved from https://www.criteo.com/fr/wp-content/uploads/sites/4/2018/08/Criteo-Shopper-Story-2017-FR.pdf

Federation of Commerce and Distribution. (2019). Evolution of trade and distribution: facts and figures . Fédération du commerce et de la distribution.

Fleishman-Hillar (2010, June 29). THE NEW CONSUMPTION PATTERNS INDUCED BY THE INTERNET MARK A DECISIVE TURNING POINT IN THE ADVERTISER/INTERNET USER RELATIONSHIP. Retrieved from Harris interactive: https://harris-interactive.fr/opinion_polls/les-nouveaux-modes-de-consommations-induits-par-internet-marquent-un-tournant-decisif-dans-la-relation-annonceurinternaute/